The undisputed heavyweight champ of online payment processing is clearly PayPal. Over 169 Million people use PayPal and it continues picking up new customers at the rate of about 10% per year. Generally speaking, most people love PayPal and an average 86% of customers say they would recommend it to others. By the way, those same customers are also spending quite a bit of money with PayPal, processing over 4 billion payments in 2014.

They’ve been around a long time. PayPal is a reputable and well-established company that started in1998. Even though it was initially created for a very different purpose, PayPal became the standard for processing payments on eBay auctions. Eventually, eBay bought the company and it grew very very quickly from there.

PayPal’s corporate reach is now long and strong, they’ve acquired multiple brands and established a worldwide presence like VeriSign, Braintree, Venmo, Xoom, Paydiant, and Modest. PayPal spent well over $2 Billion on these acquisitions to improve its business. Most importantly, PayPal has established big partnerships with major credit cards, social media, and search engines. As a result of PayPal’s growth, it’s now available in over 200 countries.

JVZoo recognized the importance of using a payment processing engine like PayPal from day one. Vendors want sales, affiliates want offers and customers need products. The founders of JVZoo knew that the answer to connecting those 3 pieces would be PayPal’s Adaptive Payment technology. The Adaptive Payments technology from PayPal allows JVZoo to properly split customer payments among all parties without complicated accounting. Using PayPal was the natural choice for JVZoo.

It’s safe to say that PayPal will be a big part of Internet Marketing because it’s become a household name. Your prospects all have a PayPal account, accepting PayPal has become as commonplace as accepting Visa or Mastercard and that’s why you need an account if you plan to do business online. It’s not impossible to do business without it, but you would be missing an enormous piece of the marketplace. PayPal’s acceptance by the customer base to the Adaptive Payments technology make it a strong ally. There are some alternative processors that have followed in PayPal’s footsteps, but we suspect PayPal will remain the king of payment processing for the foreseeable future.

PAYPAL TRUST MAKES YOU MORE SALES, MORE AFFILIATES, AND MORE MONEY.

PayPal plays a unique role in Internet commerce and is a force to be reckoned with. People know the name and they recognize the logo. Purchasing products with PayPal provides the consumer with an additional layer of protection that makes them feel warm and cozy about buying more stuff from you.

Online shoppers like that they can turn to PayPal if things go wrong with their purchase. If their product didn’t arrive or wasn’t as described PayPal serves as a dispute arbitrator between the buyer and the seller. This corporate culture and business model stems from PayPal’s early days of eBay auctions. Back then there were lots of phony auctions and PayPal became the consumer’s last line of defense. This process has served to build trust among its users. You gotta admit it yourself as a buyer, that there is a certain comfort in knowing that you can put in a PayPal dispute is a vendor stiffs you on a purchase.

Vendors and affiliates ALSO trust PayPal and benefit from its many security policies. As you know, it’s not just shady vendors that are out there trying to scam people, there are also shady consumers to watch out for, particularly in the digital product space. A very small percentage of buyers will turn out to be shysters. They might purchase your product with the intention of downloading it and instantly requesting a refund or filing a chargeback. PayPal has very specific policies for intangible items (digital items) that actually make it very easy for GOOD vendors and affiliates to prove that a transaction was legit.

Internet Marketers should be especially savvy when it comes to PayPal. PayPal is an integral part of marketing online because it’s so popular amongst your buyers. It is also important to marketers as a way to pay for their own business services, and affiliate commissions and contest winnings. Remember it’s not just your customers that use PayPal. YOUR AFFILIATES AND JV’S USE IT TOO. There are many payment platforms for your business. However, the sheer number of users is one of the reasons you’ll want to accept and use PayPal in your business.

Among others, using PayPal will give you these three big benefits:

#1 Boosts Conversion Rates – Because the majority of your customers have PayPal accounts already, they won’t have to sign up to some unknown, untrusted platform to buy your products. Even if they don’t have an account, they can still use their credit card with PayPal. No need for another payment platform.

#2 Boosts Credibility and Trust – PayPal is an established brand. People know, like and trust PayPal. When your customers see your PayPal acceptance form, they will know you’re in good standing with an organization they trust.

#3 Vendor/Affiliate Relationship Benefits – If you’re a vendor, you’ll be able to make payments to your affiliates with ease. JVZoo will automatically pay your affiliates that you’ve designated as “Instant” payout. You can also pay contest winnings the day after the contest has ended. (Obviously, you get the benefits of being paid quickly when you’re the affiliate.)

HOW TO SET UP THE RIGHT PAYPAL ACCOUNT THAT’S BEST FOR YOUR BUSINESS

One thing you’ll want to remember is that PayPal is not a bank. This may be a shock to some people because PayPal sure does take security as seriously as a bank. However, PayPal is an online payment transfer system, that’s it. They move money from one party to another. Nevertheless, PayPal is a very serious business with a comprehensive list of Legal Agreements. You will need to stay in compliance with PayPal’s terms or you could get yourself in some hot water.

Most people don’t know what type of account to have when they start their online business. The differences in the type of account you have will become more and more pertinent as your business volume starts to grow. PayPal has three account types: Personal, Premier and Business.

Personal accounts are what most people start off their online buying and selling with. This type of account is the easiest to open, you just link it up to your bank and boom you’re ready to rock. Personal accounts are mostly for purchasing goods and services as the end user. You can expect most of your customers to be using personal accounts and you may keep one for your own personal purchases. Personal accounts only give you access to the core features, and nothing more. PayPal handles customer support for Personal accounts primarily by e-mail or through a virtual customer support agent at the PayPal Web site. There’s a phone number available but frankly, it’s not toll-free and it tends to have really long wait times.

Premier accounts and Business accounts are practically the same. The main difference is that a business account has to be registered to an actual company name but a premier can be registered to a company or an individual.

Business accounts are ideal for running your online business and that’s why we suggest you apply for one these straight away. There are a couple important benefits to a business account other than using your company name when processing charges. You’ll also have the ability to allow employees have limited access to your account. You can accept debit and credit card payments. You can allow customers to set up RECURRING payments (subscriptions). And as an added perk. You get your very own PayPal ATM/debit card with your company name on it!

When applying for a business account, you will need to connect it to a business bank account. You’ll also be required to submit your Employer Identification Number (EIN). You’ll also need to provide the name of your business and a few other identifying details. All of the information that you need to provide PayPal you’ll likely have to supply to your bank when getting the business account, so we suggest you get the business bank account set up first before trying to get a business account on PayPal.

There are a wide variety of additional, more advanced features that PayPal offers for business account members. Features like PayPal Payments Pro that let you directly accept credit cards, PayPal Credit, and other payment methods. Customizable cart integration and APIs for advanced technical set ups. Also, phone-based credit card payments and online invoicing with your own virtual credit card terminal to manually process customer payments. These are all things that may come in handy as you begin to scale your business. And speaking of scaling, once you’re hitting a consistent $100k per month in sales volume you’ll even get your own PayPal rep that you can call when you need help!

NAVIGATING THE POTENTIAL DANGERS OF ONLINE PAYMENT PROCESSING

There can be a few pitfalls for you to navigate when you are launching a digital product and using PayPal as the payment processor. PayPal is committed to keeping their users accounts safe, and remember that both YOU and YOUR CUSTOMER are both PayPal “users”. Anytime there may be suspicious activity, the PayPal risk assessment and security team will leap into action. Here are a few things that can happen if they suspect your account has an issue.

Your account can potentially be limited or frozen. This can happen during your launch if you have a very large number of transactions happening in a very short period of time, ESPECIALLY if your account is new or has very little sales history. As a new account holder, PayPal expects you to make a few sales per day and slowly increase your sales transactions organically over time. During your launch, you’ll have a large volume of transactions that spikes up in a short period of time. This will raise suspicions at PayPal HQ. When your account is limited, you’ll still be able to collect payments, but you can’t pay out any money — including affiliate commissions.

PRO-TIP: If PayPal does ever limit your account they will assign an operator to reach out to you and offer assistance. (If you notice your account has been limited, you may want to call in proactively.) PayPal will want to ensure that your transactions aren’t fraudulent transactions; they’ll have a few questions for you.

Your account can be given a reserve assessment. In the event that your account is flagged as high risk, you may be given a reserve assessment. A reserve assessment is a minimum amount of money that your account must maintain at all times. You will not be able to access these funds even though the money is yours. This is to cover any potential refunds or chargebacks that occur. This will also inhibit your ability to pay your affiliates or business service providers.

In some rare circumstances, your account can be shut down. This generally only happens when PayPal has determined that there has in fact been some fraudulent activity taking place through your account. It’s certainly possible that someone could be a victim of identity theft or account hacking and PayPal takes all of this into consideration. Remember that ultimately the goal is to keep you and your customer safe from fraud and if an account ever becomes severely compromised the most assertive action can be to close that account.

PayPal has a customer base to protect. It’s entirely possible for you to operate a legitimate business and still trigger an investigation. Knowing the possible outcomes for your account will help you respond to PayPal in an appropriate manner.

AVOIDING THE PAYPAL SLINGS AND ARROWS FROM SUDDEN LAUNCH VOLUME

A few strategies need to be utilized to keep your PayPal account safe and trouble-free when you are planning product launch. Here are a few tips:

1) Choose the right type of Paypal account.

You have a few different options when it comes to types of PayPal accounts. You can have a personal account, premier account, or business account. You will probably want to go with a business account.

If you need to process credit and debit cards like a merchant, then you’ll want to sign up for Paypal Payments Pro in addition to having a business account just for that ability.

PRO-TIP: You can have up to two accounts with Paypal, but you’re going to have separate emails and separate banking information for each one.

2) Give them a heads up.

Contact Paypal in advance and have them put a note on your account. Let them know that you’re running a sale on your website during the dates of your launch. Tell them that you expect a big volume of transactions — a lot more than what you’re used to.

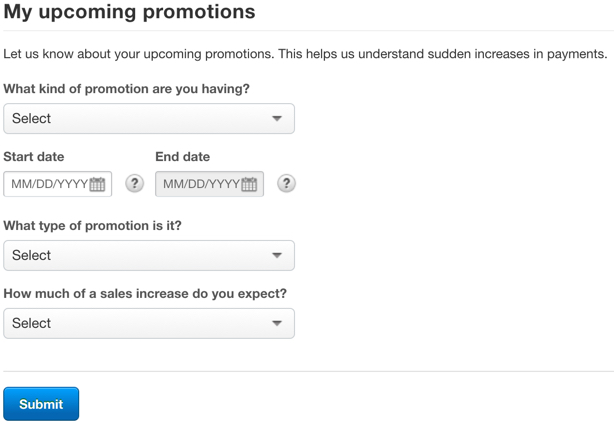

You can also notify them weeks in advance. They allow you to set a notification on your account. Under “Profile” choose “Profile and Settings”, then “My Settings”. On this page, you’ll see “My Upcoming Promotions”. Choose My Upcoming Promotions and add the details of your launch there.

3) Test everything.

Seriously, TEST EVERYTHING thoroughly before you launch your product. You should do test purchases to ensure that payments are being processed properly. Be certain that your funnel is correctly is set up and working for all possible sales combinations. Testing and retesting will almost ALWAYS uncover potential problems that would have otherwise gone unnoticed. When your sales process breaks, the customer becomes upset and may complain to PayPal. An unusual amount of complaints can throw up a red flag!

4) Keep some money in your account at ALL times

Some vendors highly recommend that you keep at least 10-15% of your sales volume in your PayPal account at all times. This is just a suggestion but we think it has good merit even if you’re not under any reserve requirements. Remember that PayPal is always monitoring for unusual activity and if you quickly pull out of your account any money that gets put in that appears “unusual”. They don’t want to get stuck holding the bag on refund requests that might come through after you’ve withdrawn the funds to cover them.

If you employ a few pro-active tactics, you will more easily avoid issues with PayPal during your launch. Be sure to communicate with them and perhaps keep a small balance in your PayPal account to show them you have skin in the game. Treat your relationship with PayPal like a business partnership and you’ll be okay.

DEALING WITH DISPUTES AND CHARGEBACKS IN YOUR BUSINESS

Look, it’s gonna happen and guess what, everything is gonna be fine! There’s a variety of reasons why a customer may want to initiate a chargeback or dispute. Sometimes it’s an easy fix, such as the customer didn’t know how to find your Help Desk to ask for a refund. Other times the customer may have buyer’s remorse on a product that had a “No Refund” policy. Maybe the reason for starting the chargeback was even malicious. Whatever the reason might be, you’re going to be cool, calm, collected and best of all PREPARED to handle it!

A dispute is when the customer logs into their PayPal account and tells PayPal directly that they didn’t purchase your product, or it wasn’t as advertised, or some other discrepancy exists. The dispute is merely a complaint and PayPal requires that the buyer and seller attempt to negotiate a resolution. If no resolution is agreed upon, then a claim can be filed within 20 days of the dispute being opened.

While the dispute is mostly a negotiating phase, those that escalate to claims become the purview of PayPal. Once the claim is filed, you will need to defend the claim, concede, or get the customer to close their claim on their own. (Getting them to close their claim is a lot harder if you’re not going to issue a refund in JVZoo.) Once the claim process has started, PayPal will investigate the matter and make a determination.

A chargeback is when the customer tells their credit card company or bank that they didn’t purchase your product or there is another issue with it. The customer will label the charge from PayPal on their statement as fraudulent or otherwise in dispute. The customer’s financial institution will contact PayPal to begin an investigation. PayPal will then follow up with you and cooperate with the customer’s banking institution. PayPal is a neutral party in this instance. Keep in mind that PayPal will reserve or “freeze” the funds for the amount in question regardless of whether it is a PayPal claim or a chargeback.

PRO-TIP: ONLY ISSUE REFUNDS FROM INSIDE YOUR JVZOO ACCOUNT. Refunding a purchase to a customer directly through PayPal will pull the entire refund amount from YOUR account only. All refunds should be done from inside JVZoo only because then all fee’s, partner splits, affiliate percentages etc. will be returned to the buyer correctly from the respective accounts.

When running a business, you will inevitably attract some difficult customers, it’s par for the course. Some of those customers might start chargebacks and disputes to further their interests. You have to understand the differences and be prepared to show PayPal that your business transaction is legit, the customer purchased the product willfully and even downloaded and used it already.

HERE’S WHAT YOU CAN DO IF YOU GET A PAYPAL DISPUTE OR CHARGEBACK

First of all, don’t freak out. Receiving chargebacks and disputes is fairly common in Internet Marketing. Many customers have different backgrounds that lead them to take potentially rash action when a simple support request would suffice. Here’s the lowdown on how to respond when you’re dealing with a customer who has escalated the situation.

If you’re going to refund the customer, then ask them to close down their dispute, claim, or chargeback inside PayPal before you give them the refund. You can then issue them a refund in JVZoo.

Refunds processed via JVZoo enable all parties who received money from the original transaction to return their portion of that money

JVZoo and PayPal receive transaction fees that will be returned. You, your contracted JVs (joint venture partners) and the affiliate will also return any money received. If you process the refund through PayPal, then you are taking the whole hit, the money for the refund comes ONLY FROM YOU.

If you believe the customer is wrong for disputing the purchase, then you can provide evidence to PayPal during the claims process. The exact nature of the evidence you will need to provide varies case-by-case. For example, if the customer claims they never received access to your product, but you noticed that they logged into your site and downloaded content, then you can show your records proving they accessed it. You will have to be prepared to provide screenshots of conversations and proof of downloads etc.

Don’t be afraid to defend yourself when a customer disputes. Remember, that the buyer and the seller are BOTH PayPal users and they want to mitigate the issue as easily as possible. By the way, if you don’t want to be bothered and just accept the blame for all these chargebacks just to be done with them… you should be careful. You don’t want to concede too many claims with PayPal, as they may suspect you’re the problem. Present your case and demonstrate proof of what happened. Be sure to have clear explanations of your return policies and demonstrations of your product on your sales page so you can easily sho PayPal that your product was in fact as described.

There are a few things to do when you’re dealing with a customer who has taken things to the next level. Fortunately, the credit card company and/or PayPal are willing to hear both sides of the story. As long as you’re clear and upfront with your customers before they buy, and you run a transparent business, you should be okay in the eyes of PayPal.

2 replies to "HERE’S WHY YOU NEED THE BIGGEST ONLINE PAYMENT PROCESSOR IN THE WORLD"

[…] using PayPal will find it imperative to protect those accounts at all costs. As we mentioned in this blog post, we recognized the importance of using a payment processing engine like PayPal from day one and […]

It’s a great article.