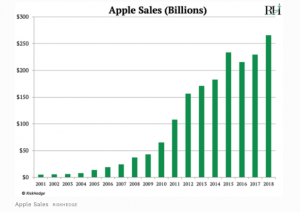

Is Apple in decline?

It may seem impossible when you look around and every other person has an iPhone.

But, the numbers are showing that Apple might…just might…be in decline.

A few weeks ago, Apple stock plunged 10% for its worst day in years. (Forbes)

You wouldn’t know that anything is amiss if you look at sales numbers. It looks like Apple is killing it just as they have since the sales jumped tenfold with the release of the first iPhone in 2007.

You wouldn’t know that anything is amiss if you look at sales numbers. It looks like Apple is killing it just as they have since the sales jumped tenfold with the release of the first iPhone in 2007.

But, things aren’t always as they seem.

Apple sells fewer and fewer iPhones every year…the phones are simply way more expensive than they were at first release.

The current iPhone X runs about $1,149!

There’s only so high they can crank up the price….and then what?

Apple has other plans on the horizon…

What about You?

Do YOU have an exit strategy?

Spencer Haws proved that it IS possible for someone in the internet marketing industry to sell their company for $1M+ and bow out.

Check out this article on how Spencer sold Longtail Pro for “a multiple of the average net income  over the most recent 12 months.”

over the most recent 12 months.”

You can learn a LOT from Spencer’s article, and it’s important to note that the final sale price was based on the actual income (revenue) of the company.

So, what does that mean for you right now?

Building your business with an exit strategy that includes the hopes of selling it one day, should include consideration for what your business revenue looks like.

For things aren’t always as they seem…

If you are selling on a platform that runs sales as the merchant of record, the revenue shows up on their account, not yours.

Basically, the cash for their cut and the money they pay out to the affiliates goes to the platform before the rest of the money hits your account. In some cases, you will only show 50% of the income for sales for your own product in your business!

Wait…what?!

Yep…you read that correctly. It sort of sounds like you work FOR the platform if they are keeping 50% of your revenue (on paper).

The big question is: are you playing the short game or the long game?

If you’re playing the short game, you’re probably concerned with your day to day earnings. You are likely worried about the short term risks. Using a platform with a merchant of record seems safer.

Don’t get me wrong…you should always be worried about short term risks. However, those who are playing the long game and actually building a business are thinking about the big picture.

Players in the long game keep their fingers on the pulse of their own business at all times. They worry more about gross and net revenue rather than day to day profit.

Let’s look at an example comparing Revenue and Profit:

Below are the figures and the income statement portion for J.C. Penney for 2017. The numbers were reported on their 10K annual statement, closing on February 03, 2018.

- Revenue or Total Net Sales = $12.50 billion.

- Gross Profit = $4.33 billion (Total revenue of $12.50B – Cost of Goods Sold of $8.17B).

- Operating Profit = $116 million (minus all other fixed and variable expenses associated with operating the business, such as rent, utilities, and payroll).

- Profit or Net income = -$116 million (a loss).

Using the numbers above, let’s pretend YOUR total sales equaled $12.50B, but your income statement only shows the $4.33B because the platform you were using used a merchant of record account who paid out the $8.17B for you.

That means your business is only showing a profit…not the true revenue produced. You’re missing out on a huge opportunity to value your business much higher in the long game.

One of the main reasons you got into internet marketing was to escape the grasp of a 9-to-5 job and work for yourself, right?

If a company is claiming your revenue as their own, you are more of an employee (or slave) to them rather than an independent business entity.

At least on paper…

JVZoo allows every penny of your sales to hit your account and show up as your revenue. Then, the 5% fee goes to JVZoo and your affiliate commissions are paid. When you look at your income statement, you’ll see the true value of your business.

Apple might not care about the decline in iPhone sales, as it seems their focus has shifted to winning the race to be first to master artificial intelligence.

While Apple clearly has a long term plan, do you? What’s your exit strategy?

Read about how some of JVZoo’s Most Successful Users run their businesses in Rise of the JVZoo Superheroes. Get it HERE.

Need help getting started with JVZoo? Sign up for our Free Training: